From Claimed to Confirmed: Reshaping Consumer Research with Verified Buyers

Over half of consumers forget the brands they buy – why verified buyers are key to accurate research

A White Paper by Numerator

How well do you remember what you purchased on your last shopping trip? What about a month ago?

Most research still relies on people self-reporting their purchases to identify buyers. But even attentive consumers don’t always remember what they bought – or the brands they bought. This raises serious concerns about research accuracy when memory is fallible.

In our prior work on survey respondent fraud, we detailed how bots, inattentive participants, and “career” survey takers cost the industry millions. But even with honest respondents, recall alone is a weak foundation for identifying true buyers. A new standard is needed – one that uses actual proof of purchase to ensure surveys reach the right audience. That standard is Verified Buyers.

This article draws on fresh research with U.S. shoppers to explore:

- The pervasiveness of forgotten recall

- The risks of using unverified respondents

- The benefits of targeting Verified Buyers for accurate insights

Forgotten Recall: A Widespread Challenge

Numerator surveyed Verified Buyers across 30+ consumer packaged goods (CPG) categories, covering Baby, Grocery, Health & Beauty, Household, and Pet sectors. The results were eye-opening: on average, over half of shoppers couldn’t recall which brand they had just bought in a category, and 20% didn’t even remember buying in the category at all.

“50%+ of consumers don’t recall the brands they recently bought in a category.”

These “forgotten recall” cases show that recall-based screening is fundamentally flawed. Without knowing how recall varies by category or brand, research using only claimed behavior can lead to incorrect conclusions and poor business decisions.

Research Quality Suffers Without Verified Buyers

We tested the impact of using claimed vs. actual behavior by dividing respondents into three cohorts:

- Confirmed Recall: said they bought the brand that they did

- Forgotten Recall: did not remember/select the brand that they bought

- False Recall: recalled a purchase not verified with a receipt

Excluding Forgotten Recall buyers overstates satisfaction scores – while including False Recall buyers risks distorting the true reasons people buy.

“By excluding Forgotten Recall Buyers, your Top Box scores may be overstated.”

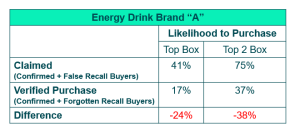

Top Box Inflation

Top Box scores – those showing the most favorable responses – are especially vulnerable. Confirmed Recall buyers are typically more engaged and give higher scores. But Forgotten Recall buyers, who are less engaged, often rate the brand more neutrally or negatively.

When you exclude these less-engaged yet valid customers, your Top Box and Top 2 Box scores appear better than they really are. This can create a false sense of security about brand performance and mask key opportunities for improvement.

Figure 1: Top Box Rating Changes When Surveying Verified Buyers vs. Claimed Buyers

Misreading What Drives Purchase

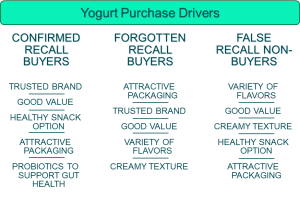

We also analyzed how each cohort ranked product attributes and decision drivers. The results showed stark differences. As shown in the example below, Verified Buyers prioritized brand trust, while False Recall respondents did not even list it as a top factor.

Figure 2: Purchase Driver Changes When Surveying Verified Buyers vs. Claimed Buyers

This misalignment is critical. If research includes the wrong sample, brand teams might chase the wrong strategy – such as focusing on product variety when trust is the real purchase driver.

Examining Verified cohorts individually can provide further insights. For example, Forgotten Recall buyers may represent opportunities to improve memorability and boost repeat purchase. But you can only discover these insights by reaching the right people to begin with.

Verified Buyers Enable Precision Targeting

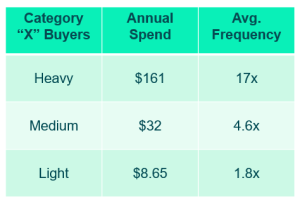

Verified Buyer data unlocks opportunities to define and understand precise targets when supported by a single-source panel. For example, brands can understand key differences of attitudes among behavioral groups like:

- Heavy, Medium, or Light buyers

- “Leaked” shoppers – those who buy the brand elsewhere but not at your retailer

These segments reveal strategic differences in how groups think and shop.

Figures 3 & 4: Heavy vs. Light Buyers & Leaked Shoppers

For example, Heavy Buyers make 9x more trips than Light Buyers, suggesting their opinions should carry greater weight in strategy development. Similarly, leaked shoppers’ attitudes can help identify why they’re not converting in a particular channel.

This level of precision simply isn’t possible without verified data.

Key Takeaways

Consumers are human – and that means they forget. But flawed memory creates a ripple effect in research: wrong people in the sample, skewed data, misleading insights, and inaccurate brand strategies.

Here’s what our research confirmed:

- Recall failure is widespread across all product categories. Relying solely on respondent memory undermines data integrity.

- Excluding Forgotten Recall buyers leads to inflated satisfaction scores and a false sense of brand strength.

- Including False Recall buyers causes misinterpretation of purchase drivers, steering brand messaging and innovation in the wrong direction.

- Verified Buyers unlock deeper insights, like behavioral segments and underleveraged shopper groups, which are invisible in traditional surveys.

Conclusion

The industry standard of relying on claimed behavior is no longer enough. Brands need to base strategic decisions on truth, not memory. Verified Buyers – proven purchasers verified by receipt data – solve this problem by ensuring that you’re surveying the right people.

Verified data improves more than just accuracy. It is the link that provides results based on authentic behavior. It enables smarter segmentation, uncovers hidden opportunities, and gives brand teams the confidence that their insights are rooted in reality.

It’s time to move from claimed to confirmed – and reshape research with Verified Buyers.

Numerator is a data and technology company bringing speed, scale, and transformation to the market research industry. In North America, Numerator blends first-party data from over 1 million U.S. households with advanced technology to deliver 360-degree insights into the path to purchase – powering faster, more accurate, and actionable research.

Building on this foundation, Numerator is expanding to Europe with the launch of a Verified Buyer survey panel in Germany. The panel is set to reach 50,000 verified buyers by the end of 2025, bringing the same data integrity and precision targeting to one of the world’s most important markets.

⏳ MRMW EU 2025 is Just Around the Corner!

Building on innovations like Verified Buyers from Numerator, MRMW EU (Nov 6–7, Berlin) will explore how research can move from claimed behavior to confirmed, driving real strategic impact.

Hear MR and CX senior leaders from Samsung, eBay, Google, LinkedIn, Appinio, Salomon, and EDP share how insights are shaping strategy, influencing the C-suite, and turning data into business growth.

💡Be part of the conversation driving tomorrow’s insights!

Reserve your seat today—seats are limited!

by

by